FIX Core Concepts¶

TradingSessionStatusRequest (g)¶

After successful authentication, it is necessary to receive an update on the status of the market (open or closed), common system parameters, and a list of securities with their characteristics. The TradingSessionStatus message is returned as a response to the TradingSessionStatusRequest and it accomplishes these things.

TradingSessionStatus Message (h)¶

The TradingSessionStatus message is used to provide an update on the status of the market. Furthermore, this message contains useful system parameters as well as information about each trading security (embedded SecurityList).

TradingSessionStatus should be requested upon successful Logon and subscribed to. The contents of the TradingSessionStatus message, specifically the SecurityList and system parameters, should dictate how fields are set when sending messages to FXCM. For example, the instrument component within SecurityList indicates minimum order quantity 9095. Subsequent NewOrderSingle (D) messages should not violate this value when setting the OrderQty field (38).

- Requesting

TradingSessionStatus

FIX44::TradingSessionStatusRequest request;

request.setField(FIX::TradSesReqID(NextId()));

request.setField(FIX::SubscriptionRequestType(FIX::SubscriptionRequestType_SNAPSHOT_PLUS_UPDATES));

- Reading System Parameters

Here we demonstrate how to extract the FXCM system properties from the TradingSessionStatus message. The code below will print out the name and value of the each of the properties. The following custom fields are used:

9016 - FXCMNoParam

9017 - FXCMParamName

9018 - FXCMParamValue

int param_count = FIX::IntConvertor::convert(status.getField(9016));

cout << "TSS - FXCM System Parameters" << endl;

for(int i = 1; i <= param_count; i++)

{

FIX::FieldMap map = status.getGroupRef(i,9016);

string param_name = map.getField(9017);

string param_value = map.getField(9018);

cout << param_name << " - " << param_value << endl;

}

FIX::Session::sendToTarget(request,session_id);

CollateralInquiry (BB)¶

CollateralInquiry is used to request the CollateralReport(BA) message from FXCM. This message contains important account related information such as the account number. With the exception of FIX sessions used solely for market data, you should include this message in your login sequence.

The login you use to connect will have access to one or more trading accounts. You will receive a CollateralReport for each of these accounts. When sending or modifying orders, you must set the Account(1) tag. This tag value must be set only to an account that you have actually received a CollateralReport for, otherwise you will see a rejection.

Requesting Market Data¶

The MarketDataSnapshotFullRefresh(W) message contains the updates to market data. It is obtained as a response to the MarketDataRequest(V) message. FIX connections are then subscription based for the market data; meaning, you must request it to receive it.

The types of data you can receive, such as the Bid price or Offer price, are referred to as MDEntryTypes in FIX. FXCM supports the following MDEntryTypes in each message: Bid(0), Offer(1), High Price(7), and Low Price(8). Additional MDEntryTypes such as MDEntryDate, MDEntryTime, QuoteCondition, etc., are found only once within the first repeating group of the message.

- Sending MarketDataRequest(V) Message

FIX44::MarketDataRequest mdr;

mdr.set(FIX::MDReqID(NextId()));

mdr.set(FIX::SubscriptionRequestType(FIX::SubscriptionRequestType_SNAPSHOT_PLUS_UPDATES));

mdr.set(FIX::MarketDepth(0));

mdr.set(FIX::NoMDEntryTypes(2));

FIX44::MarketDataRequest::NoMDEntryTypes types_group;

types_group.set(FIX::MDEntryType(FIX::MDEntryType_BID));

mdr.addGroup(types_group);

types_group.set(FIX::MDEntryType(FIX::MDEntryType_OFFER));

mdr.addGroup(types_group);

int no_sym = FIX::IntConvertor::convert(security_list.getField(FIX::FIELD::NoRelatedSym));

for(int i = 1; i <= no_sym; i++)

{

FIX44::SecurityList::NoRelatedSym sym_group;

mdr.addGroup(security_list.getGroup(i,sym_group));

}

FIX::Session::sendToTarget(mdr,session_id);

Getting Positions¶

Open and closed positions are retrieved through the PositionReport(AP) message. Unlike the ExecutionReport(8) message which contains information relating to orders, the PositionReport is not automatically sent to your FIX client. You can make individual requests for PositionReport, or you can subscribe to updates on this message. Sending a RequestForPositions(AN) message with SubscriptionRequestType(263) set to 1 (SnapshotAndUpdates) will subscribe to updates.

Open Position vs. Closed Position¶

PosReqType(724) is used to determine if a received PositionReport represents an open position or closed position. A value of 0 indicates an open position while a value of 1 indicates a closed position.

Open Positions¶

When a PositionReport representing an open position is sent to you, it will contain the price at which the position was opened. This can be seen using SettlPrice(730). The close price and the P/L of the position are not present given that the position is open. Close price and P/L are real-time calculated values and are not contain in any PositionReport where PosReqType(724) = 0 (Open Position).

Closed Positions¶

PositionReport messages representing closed positions will include the price at which the position was closed, as well as other useful information such as P/L. The following additional tags are present:

Tag Description

FXCMPosClosePNL (9052) Gross P/L of the position; e.g., $24.17, or €43.72

FXCMPosInterest (9040) Rollover interest applied to the position

FXCMPosCommission (9053) Commission applied to the position

FXCMCloseSettlPrice (9043) Close price of the position

Position Margin¶

The margin applied to each individual position can be obtained from a PositionReport representing an open position. FXCMUsedMargin(9038) will contain this margin value. Note that the total margin required for an account can be obtained by this same tag from the CollateralReport(BA) message.

Overview of Basic Order and Time-In-Force Types¶

Time-In-Force (TIF) Types¶

The Time-In-Force(59) Tag is used to indicate how long an order should remain active before it is either executed by the broker or cancelled by the client. Below are the four TIF values with descriptions.

Good Til Cancel (GTC)¶

Orders with this TIF value remain open and active until fully executed or cancelled. This means that the order remains active until the entire order amount is executed.

When to use GTC

Use GTC when your order must remain active until it can be filled Use GTC when your entire order must get filled

Day¶

Orders with this TIF value will remain open and active until fully executed, cancelled by the client, or when the trading day ends. Like Good Til Cancel (GTC), this means the order will remain active until the entire order amount is executed, unless the order is cancelled or the trading day ends.

When to use Day

Use Day when your original intention for the order becomes obsolete with time.

Immediate or Cancel (IOC)¶

Orders with this TIF value will immediately attempt to execute as much of your order as possible and cancel any remaining amount if necessary. As a result, this TIF value will allow partial fills.

When to use IOC

Use IOC when you expect execution to take place immediately Use IOC when it is acceptable if your entire order does not get filled

Fill or Kill (FOK)¶

Orders with this TIF value will attempt to execute the entire order amount immediately. If the entire order amount cannot be executed, the order is cancelled.

When to use FOK

Use FOK when you expect execution to take place immediately Use FOK when your entire order must get filled

Order Types¶

Market¶

A market order is an order to buy or sell immediately at the next available price. This means that the order is not guaranteed to fill at any specific price.

When to Use Market

Use market when your order being filled is more important than the price it is filled at.

Supported TIF Values

GTC, DAY, IOC, and FOK

Market Range (Stop-Limit)¶

Market range is a market order that comes with a limitation on the price at which the order can be filled. In other words, it is a market order with a protection against slippage (price deviation).

In FIX terms, you can convert a market order to a market range order by setting the OrdType (40) to 4 (Stop-Limit) and by setting the StopPx(99) Tag. The StopPx tag value should be set to the worst price you would accept being filled.

Example

Assume you want to Buy EUR/USD now while it is trading at 1.4531 but you do not want to get filled at a price higher than 1.4535. In this case you would set the StopPx (99) tag value to 1.4535. If your order cannot be filled at 1.4535 or below, it will be cancelled.

When to use Market Range

Use market range when you are concerned about slippage Use market range when it is acceptable that your order may be cancelled

Supported TIF Values

IOC and FOK

Limit¶

A limit order is an order to buy or sell only at a specific price (or better). In other words, the order can only be filled at the limit price or for some better price.

When to use Limit

Use limit when you must guarantee the price at which an order is filled

Supported TIF Values

GTC, Day, IOC, and FOK

Common Applications

The limit order can be used to achieve multiple objectives when combined with different TIF values. The two common application are:

GTC/Day Limit Order¶

Recall that both GTC and DAY remain active until the entire order is filled, until cancelled, or the trading day ends (for DAY orders). When you combine the limit order with these TIF values, you have an order that will remain active until the entire amount is filled at your limit price or better. This type of order is often used to close an existing position and ensure the position is closed at a specific rate.

IOC/FOK Limit Order¶

Recall that with IOC and FOK, your order will immediately attempt execution. In the case of IOC, part of the order will be filled if possible. In the case of FOK, the entire order must be filled. When you combine IOC/FOK with the limit order, you have an order which will attempt execution immediately but will fill only at your limit price or better. This order type is commonly used to guarantee the price at which a new order is filled while also controlling how much can be filled; IOC would allow partial fills while FOK would not.

Stop¶

A stop is an order to buy or sell some amount when the current market price reaches your stop price. In other words, a stop order is a market order which is waiting to be active until the market price reaches a certain level (your stop price). Given that a stop is effectively a type of market order, it does not guarantee any specific fill price.

When to use Stop

Use stop when your order being filled is more important than the price it is filled at

Supported TIF Values

GTC and DAY

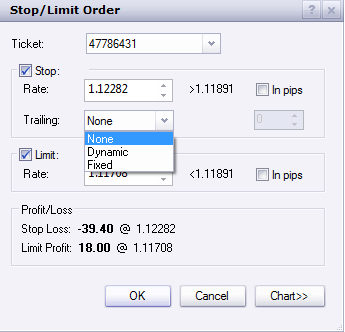

Trailing Stop Peg Order¶

How to set stop peg orders

First You need to set ELS order, then in stop order please set stop price on tag 99 and fluctuate point at tag 9061.

9061=1== dynamic9061 = from 2 to 9is invalid (you will get error “Traling step did not pass validation.” )9061=10+== fixed

How does peg orders work

ELS order with main order sell 1K USD/JPY market FOK + stop order at 99=104.504 with fluctuate point 9061=10 and limit order. Please be aware that this ELS has three orders bind together. Each order should has its own CLOrdID In this case, the stop order is 11 = 1475761911686.

11=1475761911686|67=1|583=2|1=1206026806|55=USD/JPY|54=1|60=20161006-13:51:51.682|38=1000|40=3|99=104.504|9061=10|

Main order been filled immediately at market. At the same time market rate of ask been set to tag 31 = 104.004 (this is not trigger price but you can think this is trigger reference, you can get this value in market price message 35=W) and stop price at 104.504 at tag 99.

11=1475761911686|14=0|15=USD|17=111400333|31=104.004|32=0|37=60513656|38=1000|39=0|40=P|44=104.504|54=1|55=USD/JPY|59=1

When market moved to 103.904 which is 10 points from this reference 104.004, both market price and stop price been moved 10 point. And becomes as tag 31 = 103.904 and tag 44 = 104.404 You will see the stop price change on TSII GUI also. Then it wait the market to touch 10 point off 103.904 which is 103.804.

11=1475761911686|14=0|15=USD|17=111402690|31=103.904|32=0|37=60513656|38=1000|39=0|40=P|44=104.404|54=1|55=USD/JPY|59=1|

DEBUG (2016-10-06 09:51:51,696) [QF/J Session dispatcher: FIX.4.4:FXCM/RAPID->1206026806_client1] (app) - <<< app message from counterparty: 8=FIX.4.4|9=430|35=E|34=5|49=1206026806_client1|52=20161006-13:51:51.682|56=FXCM|57=RAPID|66=1475761911669|68=3|1385=101|73=3|

11=1475761911685|67=0|583=1|1=1206026806|55=USD/JPY|54=2|60=20161006-13:51:51.682|38=1000|40=1|59=4|

11=1475761911686|67=1|583=2|1=1206026806|55=USD/JPY|54=1|60=20161006-13:51:51.682|38=1000|40=3|99=104.504|9061=10|

11=1475761911687|67=2|583=2|1=1206026806|55=USD/JPY|54=1|60=20161006-13:51:51.682|38=1000|40=2|44=103.504|10=087|

DEBUG (2016-10-06 09:51:51,702) [0:Bus:1206026806_client1FXCMRAPID] (app) - >>> app message to counterparty: 8=FIX.4.4|9=518|35=8|34=14|49=FXCM|50=RAPID|52=20161006-13:51:51.702|56=1206026806_client1|1=1206026806|6=104.504|11=1475761911686|14=0|15=USD|17=111400333|31=104.004|32=0|37=60513656|38=1000|39=0|40=P|44=104.504|54=1|55=USD/JPY|59=1|60=20161006-13:51:51|66=1475761911669|99=0|150=0|151=1000|198=60513655|211=104.504|336=FXCM|625=RAPID|835=0|836=0|1094=0|1385=101|9000=2|9041=47740717|9050=ST|9051=W|9061=10|9079=60513655|453=1|448=FXCM ID|447=D|452=3|802=4|523=6026806|803=10|523=1206026806|803=2|523=API - Test|803=22|523=32|803=26|10=105|

DEBUG (2016-10-06 09:51:51,826) [0:Bus:1206026806_client1FXCMRAPID] (app) - >>> app message to counterparty: 8=FIX.4.4|9=505|35=8|34=19|49=FXCM|50=RAPID|52=20161006-13:51:51.826|56=1206026806_client1|1=1206026806|6=104.504|11=1475761911686|14=0|15=USD|17=111400508|31=104.004|32=0|37=60513656|38=1000|39=0|40=P|44=104.504|54=1|55=USD/JPY|59=1|60=20161006-13:51:51|66=1475761911669|99=0|150=0|151=1000|211=104.504|336=FXCM|625=RAPID|835=0|836=0|1094=0|1385=101|9000=2|9041=47740717|9050=ST|9051=W|9061=10|9079=60513655|453=1|448=FXCM ID|447=D|452=3|802=4|523=6026806|803=10|523=1206026806|803=2|523=API - Test|803=22|523=32|803=26|10=246|

DEBUG (2016-10-06 10:03:26,724) [0:Bus:1206026806_client1FXCMRAPID] (app) - >>> app message to counterparty: 8=FIX.4.4|9=505|35=8|34=33|49=FXCM|50=RAPID|52=20161006-14:03:26.724|56=1206026806_client1|1=1206026806|6=104.404|11=1475761911686|14=0|15=USD|17=111402690|31=103.904|32=0|37=60513656|38=1000|39=0|40=P|44=104.404|54=1|55=USD/JPY|59=1|60=20161006-14:03:26|66=1475761911669|99=0|150=0|151=1000|211=104.404|336=FXCM|625=RAPID|835=0|836=0|1094=0|1385=101|9000=2|9041=47740717|9050=ST|9051=W|9061=10|9079=60513655|453=1|448=FXCM ID|447=D|452=3|802=4|523=6026806|803=10|523=1206026806|803=2|523=API - Test|803=22|523=32|803=26|10=248|

Dynamic peg example: ``9061=1``

8=FIX.4.4|9=515|35=E|34=6|49=1206026806_client1|52=20161007-14:53:41.963|56=FXCM|57=RAPID|66=FIX.4.4:1206026806_client1->FXCM/RAPID-14758520217125|68=3|1385=101|73=3|11=FIX.4.4:1206026806_client1->FXCM/RAPID-1475852021962-6|67=0|583=1|1=1206026806|55=EUR/USD|54=2|38=10000|40=1|11=FIX.4.4:1206026806_client1->FXCM/RAPID-1475852021962-7|67=1|583=2|1=1206026806|55=EUR/USD|54=1|38=10000|40=3|99=1.12401|9061=1|11=FIX.4.4:1206026806_client1->FXCM/RAPID-1475852021963-8|67=2|583=2|1=1206026806|55=EUR/USD|54=1|38=10000|40=2|44=1.11725|10=228|

Peg been triggered, price in tag ``44`` is in dynamic

DEBUG (2016-10-07 10:53:41,821) [0:Bus:1206026806_client1FXCMRAPID] (app) - >>> app message to counterparty: 8=FIX.4.4|9=600|35=8|34=69|49=FXCM|50=RAPID|52=20161007-14:53:41.821|56=1206026806_client1|1=1206026806|6=1.12401|11=FIX.4.4:1206026806_client1->FXCM/RAPID-1475852021962-7|14=0|15=EUR|17=111563733|31=1.11922|32=0|37=60576267|38=10000|39=0|40=P|44=1.12401|54=1|55=EUR/USD|59=1|60=20161007-14:53:41|66=FIX.4.4:1206026806_client1->FXCM/RAPID-14758520217125|99=0|150=0|151=10000|198=60576266|211=1.12401|336=FXCM|625=RAPID|835=0|836=0|1094=0|1385=101|9000=1|9041=47788992|9050=ST|9051=W|9061=1|9079=60576266|453=1|448=FXCM ID|447=D|452=3|802=4|523=6026806|803=10|523=1206026806|803=2|523=API - Test|803=22|523=32|803=26|10=244|

DEBUG (2016-10-07 10:53:41,959) [0:Bus:1206026806_client1FXCMRAPID] (app) - >>> app message to counterparty: 8=FIX.4.4|9=587|35=8|34=75|49=FXCM|50=RAPID|52=20161007-14:53:41.959|56=1206026806_client1|1=1206026806|6=1.12401|11=FIX.4.4:1206026806_client1->FXCM/RAPID-1475852021962-7|14=0|15=EUR|17=111563912|31=1.11922|32=0|37=60576267|38=10000|39=0|40=P|44=1.12401|54=1|55=EUR/USD|59=1|60=20161007-14:53:41|66=FIX.4.4:1206026806_client1->FXCM/RAPID-14758520217125|99=0|150=0|151=10000|211=1.12401|336=FXCM|625=RAPID|835=0|836=0|1094=0|1385=101|9000=1|9041=47788992|9050=ST|9051=W|9061=1|9079=60576266|453=1|448=FXCM ID|447=D|452=3|802=4|523=6026806|803=10|523=1206026806|803=2|523=API - Test|803=22|523=32|803=26|10=132|

DEBUG (2016-10-07 10:53:42,060) [0:Bus:1206026806_client1FXCMRAPID] (app) - >>> app message to counterparty: 8=FIX.4.4|9=581|35=8|34=77|49=FXCM|50=RAPID|52=20161007-14:53:42.060|56=1206026806_client1|1=1206026806|6=1.124|11=FIX.4.4:1206026806_client1->FXCM/RAPID-1475852021962-7|14=0|15=EUR|17=111563914|31=1.11921|32=0|37=60576267|38=10000|39=0|40=P|44=1.124|54=1|55=EUR/USD|59=1|60=20161007-14:53:42|66=FIX.4.4:1206026806_client1->FXCM/RAPID-14758520217125|99=0|150=0|151=10000|211=1.124|336=FXCM|625=RAPID|835=0|836=0|1094=0|1385=101|9000=1|9041=47788992|9050=ST|9051=W|9061=1|9079=60576266|453=1|448=FXCM ID|447=D|452=3|802=4|523=6026806|803=10|523=1206026806|803=2|523=API - Test|803=22|523=32|803=26|10=079|

DEBUG (2016-10-07 10:53:42,571) [0:Bus:1206026806_client1FXCMRAPID] (app) - >>> app message to counterparty: 8=FIX.4.4|9=587|35=8|34=78|49=FXCM|50=RAPID|52=20161007-14:53:42.571|56=1206026806_client1|1=1206026806|6=1.12396|11=FIX.4.4:1206026806_client1->FXCM/RAPID-1475852021962-7|14=0|15=EUR|17=111563915|31=1.11917|32=0|37=60576267|38=10000|39=0|40=P|44=1.12396|54=1|55=EUR/USD|59=1|60=20161007-14:53:42|66=FIX.4.4:1206026806_client1->FXCM/RAPID-14758520217125|99=0|150=0|151=10000|211=1.12396|336=FXCM|625=RAPID|835=0|836=0|1094=0|1385=101|9000=1|9041=47788992|9050=ST|9051=W|9061=1|9079=60576266|453=1|448=FXCM ID|447=D|452=3|802=4|523=6026806|803=10|523=1206026806|803=2|523=API - Test|803=22|523=32|803=26|10=173|

DEBUG (2016-10-07 10:53:43,131) [0:Bus:1206026806_client1FXCMRAPID] (app) - >>> app message to counterparty: 8=FIX.4.4|9=587|35=8|34=79|49=FXCM|50=RAPID|52=20161007-14:53:43.131|56=1206026806_client1|1=1206026806|6=1.12393|11=FIX.4.4:1206026806_client1->FXCM/RAPID-1475852021962-7|14=0|15=EUR|17=111563916|31=1.11914|32=0|37=60576267|38=10000|39=0|40=P|44=1.12393|54=1|55=EUR/USD|59=1|60=20161007-14:53:43|66=FIX.4.4:1206026806_client1->FXCM/RAPID-14758520217125|99=0|150=0|151=10000|211=1.12393|336=FXCM|625=RAPID|835=0|836=0|1094=0|1385=101|9000=1|9041=47788992|9050=ST|9051=W|9061=1|9079=60576266|453=1|448=FXCM ID|447=D|452=3|802=4|523=6026806|803=10|523=1206026806|803=2|523=API - Test|803=22|523=32|803=26|10=157|

Invalid peg example

8=FIX.4.4|9=515|35=E|34=6|49=1206026806_client1|52=20161007-16:06:30.401|56=FXCM|57=RAPID|66=FIX.4.4:1206026806_client1->FXCM/RAPID-14758563901965|68=3|1385=101|73=3|

11=FIX.4.4:1206026806_client1->FXCM/RAPID-1475856390400-6|67=0|583=1|1=1206026806|55=EUR/USD|54=2|38=10000|40=1|

11=FIX.4.4:1206026806_client1->FXCM/RAPID-1475856390401-7|67=1|583=2|1=1206026806|55=EUR/USD|54=1|38=10000|40=3|99=1.12019|9061=2|

11=FIX.4.4:1206026806_client1->FXCM/RAPID-1475856390401-8|67=2|583=2|1=1206026806|55=EUR/USD|54=1|38=10000|40=2|44=1.11344|10=236|

8=FIX.4.4|9=557|35=8|34=7|49=FXCM|50=RAPID|52=20161007-16:06:30.470|56=1206026806_client1|1=1206026806|6=1.11524|11=FIX.4.4:1206026806_client1->FXCM/RAPID-1475856390400-6|14=0|15=EUR|17=111586686|31=1.11524|32=0|37=60582259|38=10000|39=0|40=1|44=1.11524|54=2|55=EUR/USD|59=1|60=20161007-16:06:30|66=FIX.4.4:1206026806_client1->FXCM/RAPID-14758563901965|99=0|150=0|151=10000|211=0|336=FXCM|625=RAPID|835=0|836=0|1094=0|9000=1|9041=47793540|9050=OM|9051=P|9061=0|453=1|448=FXCM ID|447=D|452=3|802=4|523=6026806|803=10|523=1206026806|803=2|523=API - Test|803=22|523=32|803=26|10=156|

8=FIX.4.4|9=646|35=8|34=8|49=FXCM|50=RAPID|52=20161007-16:06:30.471|56=1206026806_client1|1=1206026806|6=1.12019|11=FIX.4.4:1206026806_client1->FXCM/RAPID-1475856390401-7|14=0|15=EUR|17=0|31=0|32=0|37=NONE|38=10000|39=8|40=3|44=1.12019|54=1|55=EUR/USD|58=19915;DAS 19915: ZDas Exception ORA-20115: Traling step did not pass validation.|59=1|60=20161007-16:06:30|66=FIX.4.4:1206026806_client1->FXCM/RAPID-14758563901965|99=1.12019|103=99|150=8|151=0|211=0|336=FXCM|625=RAPID|835=0|836=0|1094=0|9000=1|9025=0|9029=19915;DAS 19915: ZDas Exception ORA-20115: Traling step did not pass validation.|9051=R|9061=0|453=1|448=FXCM ID|447=D|452=3|802=1|523=6026806|803=10|10=153|

Fixed peg example

8=FIX.4.4|9=516|35=E|34=6|49=1206026806_client1|52=20161007-13:44:16.267|56=FXCM|57=RAPID|66=FIX.4.4:1206026806_client1->FXCM/RAPID-14758478560675|68=3|1385=101|73=3|

11=FIX.4.4:1206026806_client1->FXCM/RAPID-1475847856266-6|67=0|583=1|1=1206026806|55=EUR/USD|54=2|38=10000|40=1|

11=FIX.4.4:1206026806_client1->FXCM/RAPID-1475847856267-7|67=1|583=2|1=1206026806|55=EUR/USD|54=1|38=10000|40=3|99=1.12382|9061=10|

11=FIX.4.4:1206026806_client1->FXCM/RAPID-1475847856267-8|67=2|583=2|1=1206026806|55=EUR/USD|54=1|38=10000|40=2|44=1.11708|10=103|

Handling of Partial Fills¶

Order Quantity Fields¶

There are three fields which can be used to determine the quantity filled or rejected by FXCM. These fields are:

- LastQty (32) – the quantity filled on the last successful attempt to fill the order

- CumQty (14) – the total quantity filled

- LeavesQty (151) – the remaining quantity to be filled

- Importance of OrdStatus (39)

It is important to consider

OrdStatus (39)when using the quantity fields above. As FXCM is attempting to execute an order, the values ofOrdStatuswill progress from an initial value ofNew (0)to some final state. There are three possible final values forOrdStatus:

- OrdStatus = Filled (2)

- OrdStatus = Rejected (8)

- OrdStatus = Cancelled (4)

When you receive an ExecutionReport

8withOrdStatusset to one of these final values, you can inspect theCumQty (14)field to determine the total amount executed. IfOrdStatus=Filled(2), the entire order was filled andCumQtywill equal the originalOrdQtyvalue. IfOrdStatus=Rejected (8), the order was partially filled andCumQtywill be some value less than the originalOrdQty.

Example Partial Fill¶

The following ExecutionReport messages serve as an example of a partially filled order. The original OrderQty(38) was 1,000,000. In this example only 600,000 of the order was filled. The most important line here is the last, where we can see a finalOrdStatusvalue (Rejected in this case). When this lastExecutionReportis received, we can inspectCumQty(14)to see that 600,000 was filled.

OrderQty(38) = 1,000,000; OrdStatus(39) = New

6=85.558 14=0 17=59342024 31=85.558 32=0 37=31654622 38=1000000 39=0 40=4 44=85.55 854=2 59=3 99=0 150=0 151=1000000 211=0835=0 836=0 1094=0 9000=17 9041=13151786 9050=OR 9051=P 9061=0

OrderQty(38) = 1,000,000; OrdStatus(39) = Stopped

6=85.558 14=0 17=59342025 31=85.558 32=0 37=31654622 38=1000000 39=7 40=4 44=85.55 854=2 59=3 99=0 150=7 151=1000000 211=0835=0 836=0 1094=0 9000=17 9041=13151786 9050=OR 9051=U 9061=0

OrderQty(38) = 1,000,000; OrdStatus(39) = Stopped

6=85.488 14=0 17=59342047 31=85.488 32=0 37=31654622 38=1000000 39=7 40=4 44=85.48 854=2 9=3 99=0 150=7 151=1000000 211=0835=0 836=0 1094=0 9000=17 9041=13151786 9050=OR 9051=U 9061=0

OrderQty(38) = 1,000,000; OrdStatus(39) = Partially Filled; LastQty(32) = 600,000; CumQty(14) = 600,000

6=85.488 14=600000 17=59342048 31=85.488 32=600000 37=31654622 38=1000000 39=1 40=4 44=85.488 54=259=399=0 150=F 151=400000 211=0 835=0 836=0 1094=0 9000=17 9041=13151888 9050=OR 9051=U 9061=0

OrderQty(38) = 1,000,000; OrdStatus(39) = Rejected; CumQty(14) = 600,000

6=85.488 14=600000 17=59342049 31=85.488 32=0 37=31654622 38=1000000 39=8 40=4 44=85.488 54=258=Rejected 59=399=0 150=8 151=0 211=0 835=0 836=0 1094=0 9000=17 9041=13151888 9050=OR 9051=R 9061=0

Closing A Position¶

How you close a position depends upon the position maintenance type of the account. Some accounts support hedging while others do not. Hedging is the ability to have two positions in the same symbol but of a different side; for example, holding both Buy EUR/USD and Sell EUR/USD positions at the same time.

Accounts with Hedging

Accounts that support hedging allow you to close individual positions, regardless of when they were opened relative to other positions. Clearly with these accounts, Buy and Sell orders do not offset themselves but instead form a hedge. Consequently, you must close these positions with a NewOrderSingle message that specifies theTicketIDto close.

Sending A Closing Order¶

NewOrderSingle (D) can be used to close a specific position simply by setting theFXCMPosID (9041)field. This converts a basic market order into a closing order.

- Closing Order in Code

FIX44::NewOrderSingle order;

order.setField(ClOrdID(NextClOrdID()));

order.setField(Account(account_ID));

order.setField(Symbol("EUR/USD"));

order.setField(Side(Side_BUY));

order.setField(TransactTime());

order.setField(OrderQty(10000));

order.setField(OrdType(OrdType_MARKET));

order.setField(FXCM_POS_ID/*9041*/, ”84736256”);

Session::sendToTarget(order, session_ID);

Accounts without Hedging

For accounts without hedging, orders of the opposite Side cancel each other out; e.g., sending aNewOrderSinglewith a Side of Buy will net against any existing Sell positions. This netting is done in First-In, First-OutFIFOorder. As a result, a basic market order will suffice to close any open position.

Getting Account Position Maintenance¶

The position maintenance type of each account can be retrieved from the Parties component ofCollateralReport (BA). TheNoPartySubIDsgroup contains a custom PartySubIDType for position maintenance. This specificPartySubIDTypetag is set to a value of4000.PartySubIDcan be checked for the value of position maintenance.Y= “Hedging Enabled,”N= “No Hedging,” and0= “Netting.” Anything other thanYimplies hedging is disabled and we will not use closing orders.

Getting Position Maintenance in Code¶

int number_subID = IntConvertor::convert(group.getField(FIELD::NoPartySubIDs));

for(int u = 1; u <= number_subID; u++){

FIX44::CollateralReport::NoPartyIDs::NoPartySubIDs sub_group;

group.getGroup(u, sub_group);

string sub_type = sub_group.getField(FIELD::PartySubIDType);

string sub_value = sub_group.getField(FIELD::PartySubID);

if(sub_type == "4000"){

// Check sub_value for position maintenance

// Y = Hedging

// N = No Hedging

// 0 = Netting

}

}

When To Reset MsgSeqNum¶

Reset On Logon¶

MsgSeqNum should be reset upon each Logon. This means that every Logon message should include tags MsgSeqNum (34) set to “1” and ResetSeqNumFlag (141) set to “Yes.” It is necessary to reset upon each Logon due to the fact that connections to FXCM are load balanced against a cluster of servers. This promotes a stable trading environment for users, but it also means you should reset upon each Logon.

Example Logon Message:

8(BeginString)=FIX.4.4

9(BodyLength)=114

35(MsgType)=A

34(MsgSeqNum)=1

49(SenderCompID)=sender_client1

52(SendingTime)=20120927-13:15:34.754

56(TargetCompID)=FXCM

57(TargetSubID)=U100D1

553(Username)=some_user

554(Password)=some_password

98(EncryptMethod)=0

108(HeartBtInt)=30

141(ResetSeqNumFlag)=Y

10(CheckSum)=146

Account Equity¶

FIX API does not have a field which represents account equity. Equity is a real-time value that is dependent upon a floating price. If your application needs immediate access to equity in real-time, you would have to calculate it using market data. However, the CollateralReport (BA) does provide an equity value that corresponds with a specific time in the trading day.

StartCash(921)¶

The StartCash (921) field from CollateralReport is the equity value of the account at 5:00pm EST (New York). This can be used as a snapshot of what the equity was at that time. This value will include the account balance and any profit or loss on open trades.

Steps To Retrieve Short Version Of Market Price¶

FXCM give client an oppertunity to retrieve market price for just Bid/Ask, please follow instructions at here.

EMF¶

Note

Important detail to note about order execution with FXCM is the difference between order fill notification and order finished notification. As an order is filled by a liquidity provider, client will be sent a fill confirmation in the form of an execution report that includes 35=8|39=7|150=F or, in case of a partial fill, 35=8|39=1|150=F. This confirmation is sent as soon as the LP confirms the trade. After the order is completed and every database operation associated with it is committed, the client will be sent an execution report of order being done. This execution report includes 35=8|39=2|150=F.Alternatively, if the order was filled only partially before being canceled, the final confirmation will include 35=8|39=4|150=4. You can find the remaining quantity that was not filled in tag 151. It is important to note, that the final execution report can be sent much later. When looking for fill confirmations, clients can take advantage of faster notifications than before implementing EMF. Even if clients are not taking advantage of the EMF execution, they will always be notified of the orders being filled. The only difference would be the delivery delay.

Execution Disclaimer¶

FXCM aggregates bid and ask prices from a pool of liquidity providers and is the final counterparty when trading forex on FXCM’s dealing desk and No Dealing Desk (NDD) execution models. With NDD, FXCM’s platforms display the best-available direct bid and ask prices from the liquidity providers. In addition to the spread, the trading cost with NDD is a fixed lot-based commission at the open and close of the trade. While generally NDD accounts offer spreads with no markups, in some circumstances, FXCM may add a markup to NDD spreads. This may occur due to, but not limited to, account type, such as accounts opened through a referring agent. With dealing desk execution, FXCM can act as the dealer on any or all currency pairs. Backup liquidity providers fill in when FXCM does not act as the dealer. FXCM’s dealing desk has fewer liquidity providers than NDD. There are many other factors to consider when choosing an execution model (such as conflict of interest, trading style or strategy). See Execution Risks. Note: Contractual relationships with liquidity providers are consolidated through the FXCM Group, which, in turn, provides technology and pricing to the group affiliate entities.

Disclaimer

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 73.62% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money. High Risk Investment Notice: Trading Forex/CFD’s on margin carries a high level of risk and may not be suitable for all investors as you could sustain losses in excess of deposits. The products are intended for retail, professional and eligible counterparty clients. For clients who maintain account(s) with Forex Capital Markets Limited (“FXCM LTD”), retail clients could sustain a total loss of deposited funds but are not subject to subsequent payment obligations beyond the deposited funds and professional clients could sustain losses in excess of deposits. Prior to trading any products offered by FXCM LTD, inclusive of all EU branches, FXCM Australia Pty. Limited, FXCM South Africa (PTY) Ltd, any affiliates of aforementioned firms, or other firms within the FXCM group of companies [collectively the “FXCM Group”], carefully consider your financial situation and experience level. If you decide to trade products offered by FXCM Australia Pty. Limited (“FXCM AU”) (AFSL 309763), you must read and understand the Financial Services Guide, Product Disclosure Statement and Terms of Business. Our Forex/CFD prices are set by FXCM, are not made on an Exchange and are not governed under the Financial Advisory and Intermediary Services Act. The FXCM Group may provide general commentary which is not intended as investment advice and must not be construed as such. Seek advice from a separate financial advisor. The FXCM Group assumes no liability for errors, inaccuracies or omissions; does not warrant the accuracy, completeness of information, text, graphics, links or other items contained within these materials. Read and understand the Terms and Conditions on the FXCM Group’s websites prior to taking further action.”